This study is part of the redesign of an existing web platform into an app. Due to privacy matters it won’t be possible to share images of the web platform.

During our customer’s life cycle, there might be a time when they need to update their loan information, from their address to their employer up to the amount of their installments.

From a business perspective, this possibility was only offered to the customer on their dashboard when they became delinquent, due to implications such alterations might have on their loan eligibility.

Customer JouRney

Knowing the only scenario possible is that the customer is delinquent, our customer’s journey, on their end, would consist of two main steps: the first one is the choice of how they would like to fix their delinquency status, and the second one is the actual updating of their loan terms.

CHOOSING THE BEST OPTION?...

On this first step, when our customer reached their dashboard they would be greeted with a delinquent-related warning with 3 options: two of them led to updating their loan information and one to fully paying off their loan.

But why only 3, or better 2 options? Shouldn’t they be allowed to make a payment for what they owe?

“If they want to make a payment, they have other means to do that”

That was what the stakeholders told me… They were not wrong, we actually offer it on the customer’s dashboard… so why not help them?… Funny enough, not long after I heard this while going through the customer support logs, these were common interactions:

“I thought I was making a payment! Can you revert my loan to its previous configuration?”

“I need that money [used to pay in full the loan] back! Can you cancel this payment?”

There it was! Proof that we were not helping our customers and probably losing money because we offer discounts on both options!

Based on that I reviewed the customer’s alternatives and, in order of least impact on the business, they were: making a payment (of any amount), updating their loan, and paying off their loan in one payment.

The customers also complained about not fully understanding the product (loan update) and the difference between them

WHAT CUSTOMERS SHOULD SEE...

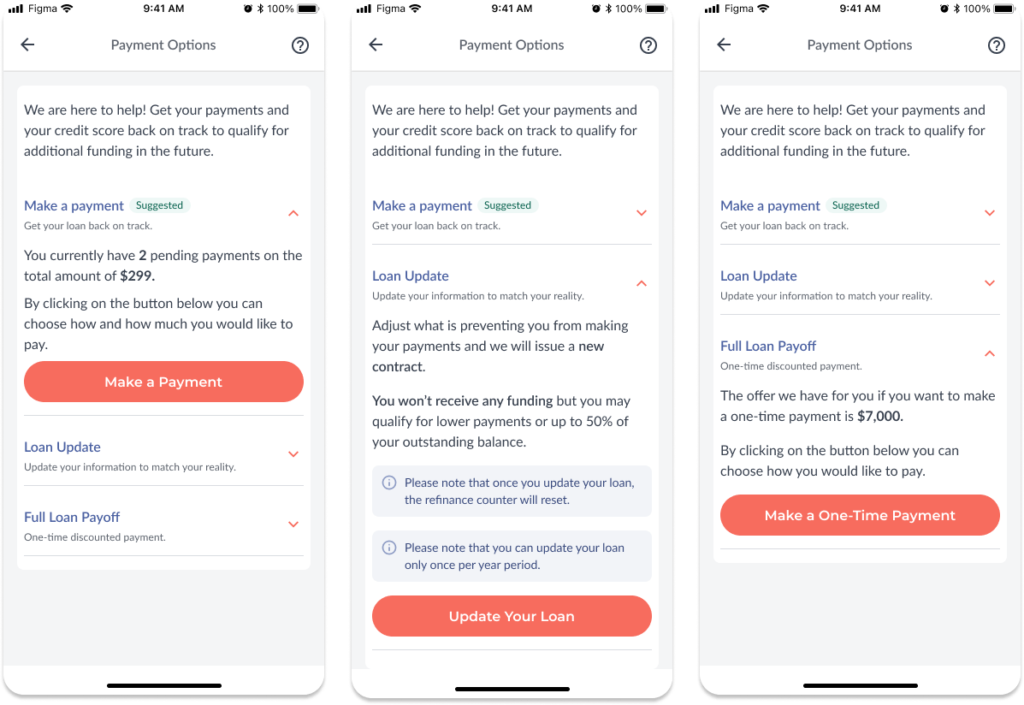

Based on my findings, I proposed the following:

- Add a small description of each product, clarifying its use and purpose;

- Show the customer beforehand the amount they are expected to pay from each payment option, and;

- Present all the possibilities available to our customers, even if they can do the same through other features presented on their dashboard.

Since we, the company, are the only ones fully educated on all the system’s capabilities, we should make it clear to the customers what options they have. By doing that, the company would benefit from possible less financial impact (not many discounts offered) and improve transparency and trust with our customers.

For all that to become a reality, this is the proposed updated design: